How we invest

Focus on portfolio construction

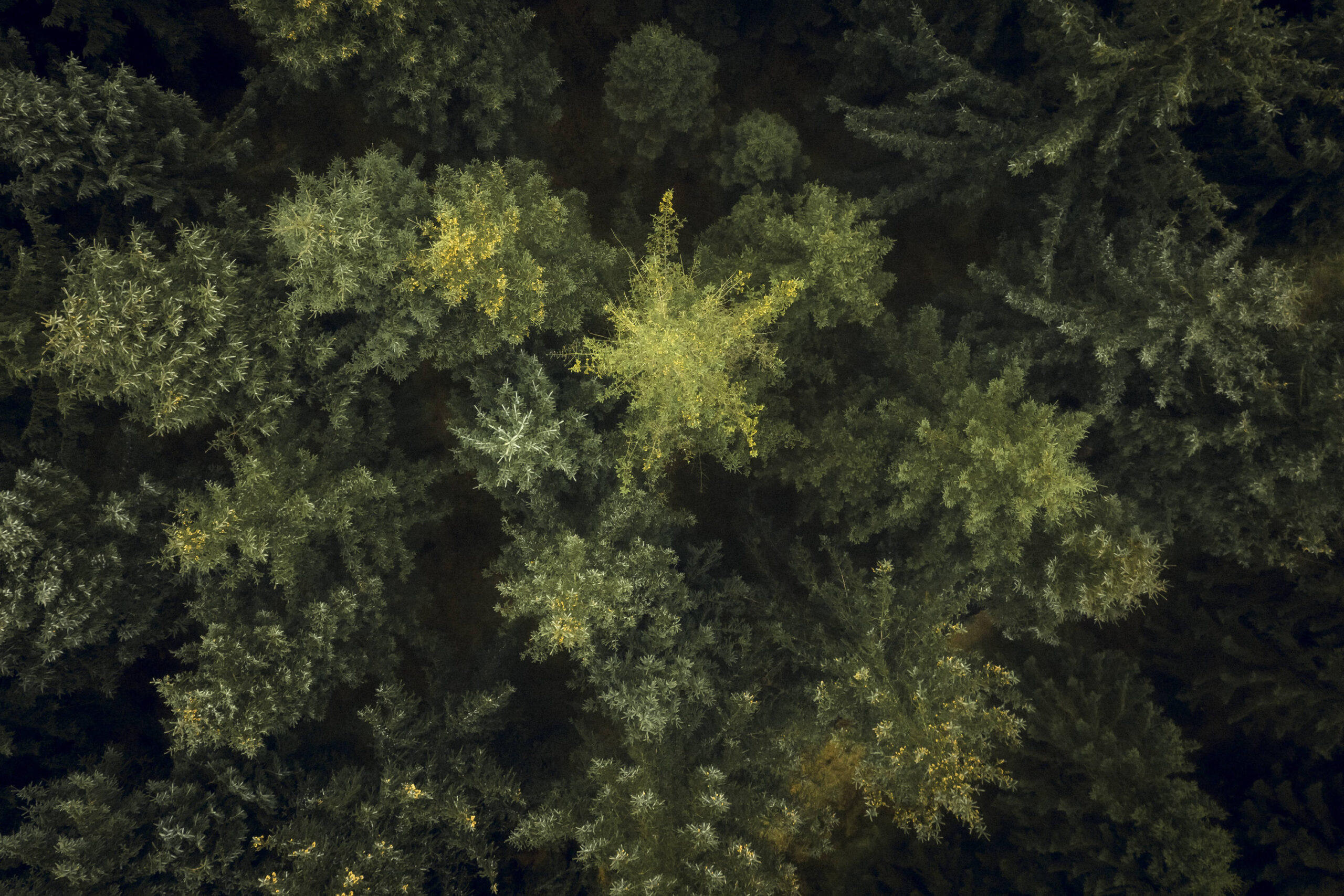

We invest globally without regard to geography and in all known asset classes, including hedge funds, private equity, real estate and forestry. We outsource securities selection, and our focus is on portfolio construction, manager selection and risk management. We work with some of the world’s best asset managers.

About Kirk Kapital Fondsmæglerselskab

We currently manage 22 portfolios for seven families and one charitable foundation, with total assets of approximately DKK 12 billion. We offer tailor-made solutions for each client, taking into account business activities and other assets to ensure the right risk profile.

Our strengths lie not least in our independence, which allows us to choose the best solutions for our partners, and in our family-based ownership with a multi-generational focus.

Investment philosophy

At Kirk Kapital Fondsmæglerselskab, we operate with time horizons that span several generations. We therefore associate investment with patience and discipline.

For us, investing is first and foremost about getting paid for taking risks: Any risk beyond a safe investment in the money market requires compensation in the form of a higher expected return. And because as long-term investors we can absorb periodic losses, we can undertake risks for as high compensation as possible.

In investment terms, we call that compensation a premium – a premium that we, demand to receive for the associated risks. We like to say that as long-term investors, we reap risk premia over time. This is at the heart of our investment philosophy.

This philosophy stems from the view that financial markets are efficient over the long term and that there is a rational relationship between the expected return on an asset and the associated risk.

This means that we appreciate the returns that can be achieved by investing passively in the financial markets. We call it a market return. In the long term, market returns are highly sought after, and many investors have to settle for less.

However, this does not deter us from seeking superior, risk-adjusted returns. One source of this may be our investments in illiquid asset classes such as private equity and hedge funds. Another source is a tactical rotation between asset classes, taking advantage of the fact that different economic cycles reward various types of investments differently over time.

Asset classes

We have a strong focus on alternatives, such as private equity, and have built new programmes for a number of our partners in recent years.

Cost structure

Our cost structure is completely transparent, with a fixed fee on AUM payment and no hidden fees or kickbacks to us from our counter parts. All economies of scale in terms of lower costs to external asset managers, brokerage fees and custody fees automatically accrue to all our clients. This way, we are more like a club than a conventional asset manager, and we have no internally managed products to take precedence in portfolios.

Free choice of custodian bank

We offer our clients a free choice of custodian banks, and we execute our transactions through several trading counterparties. We attend to all transactions, including calls and distributions from private equity funds, and provide daily access to portfolios through an online reporting tool.

Financial supervisory authority

We are regulated by the Danish Financial Supervisory Authority, and we meet formal requirements such as the certification of our portfolio managers.